Stay close to Morocco with Moneytrans

We take care of you and your loved ones. Now you can send money to Morocco from Netherlands with your own mobile phone, without leaving your home and in just a few minutes.

Your first money transfer for FREE by using the code WELCOME

.

Your money transfer to Morocco with maximum security

We have the best network of partners in Morocco!

Your funds are 100% guaranteed as Moneytrans is regulated and authorised by the National Bank of Belgium

Payment system verified by Mastercard.

We work with the safest banks and payer networks in the world

- Official partners of Moneytrans -

How to register and start sending money online

Register free of charge

Register on our website or download the iMoneytrans app free of charge.

Choose the country and the amount to send

We’ll show you the prices, commission and amount to be received before the money is sent.

Add your beneficiary’s details

Enter the details of the recipient in the destination country.

Confirm your identity

This is vitally important for the security of your money and for your peace of mind.

Pay for your transfer

Choose the payment method that’s best for you.

Done!

Your transfer is on its way! You can track it from your account.

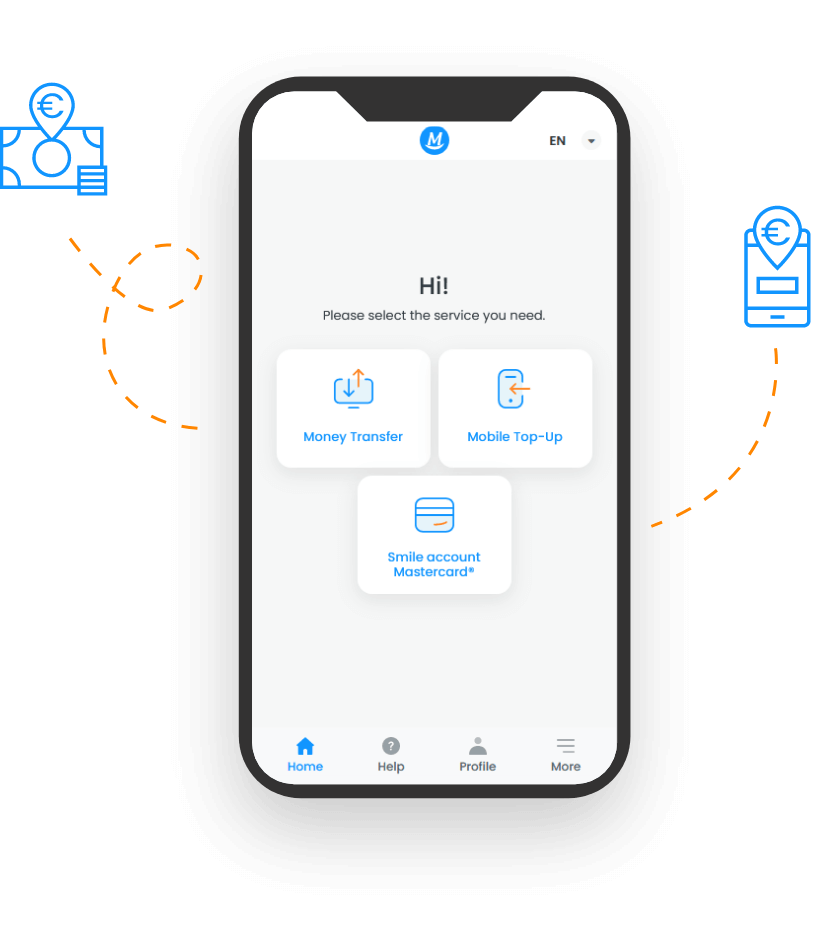

Moroccans' favourite app

Trying is adopting

Sending money online is cheaper and safer than ever before. And with travel restrictions across the world, there’s no better way to bring you closer to your loved ones.

What makes iMoneytrans the world’s best money transfer app?

- You can register in just 5 minutes

- Easy to navigate

- Free to download

- Calculate the fee with the click of a button before sending

- Your data is safe and secure

- Easy to track your transfer at any time

Send money instantly anywhere, anytime.

Why choose Moneytrans

Awarded Best Money Transfer Company

For its speed and reliable service

+ 20 years of experience

+ 10,000,000 customers trust in us

Great value rates

90% cheaper than a bank

We're where you need us to be

Available 7/7 and in your language

Extensive network

140 countries & + 450,000 payment locations

Awarded Best Money Transfer Company

For its speed and reliable service

+ 20 years of experience

+ 10,000,000 customers trust in us

Great value rates

90% cheaper than a bank

Our legendary closeness

Available 7/7 and in your language

Extensive network

140 countries & + 450,000 payment locations

How can I send money to Morocco from Netherlands?

It’s not just how much or with whom, but how you send it. At Moneytrans we know that security and proximity are very important to you and that’s why we offer two options to save you time and money.

Branches near you

We are close to you. We have hundreds of branches located in the main cities of Netherlands where you can go to make your transfer with the personalised assistance in your language, 365 days a year.

Online transfers

Without leaving your home! Register for free on our website or app, follow 3 simple steps and your money will arrive in Morocco instantly.

How and where can the money be collected?

We know that it is important for you to be able to choose. Discover the options your beneficiary has for receiving money in Morocco.

Collect cash at an authorised payment point

Choose one of the 6.500 payment locations throughout the country. With this option, the beneficiary can pick up the money as soon as the transfer is completed.

Delivery time is 1 hour (depending on correspondent).

Bank deposit

Send money straight to your recipient’s bank account.

Delivery time depends on the bank: 48-72h.

You can choose from the following banks and financial institutions:

For cash pickup, Cash Plus, BMCE Bank, Wafacash, La Poste and Al Barid Bank branches are available. For payments to bank account, Moneytrans works with Morocco’s major banks, including Attijariwafa Bank and Banque Populaire.

It’s always easier with a video!

We’ll show you step by step how to access the multiservice application and make your transfer within just 5 minutes.

Contact us

HELP CENTER

Your questions are 7/7 and so are we